World

Suspected Haiti gang members stoned, set on fireplace by crowd | Crime Information

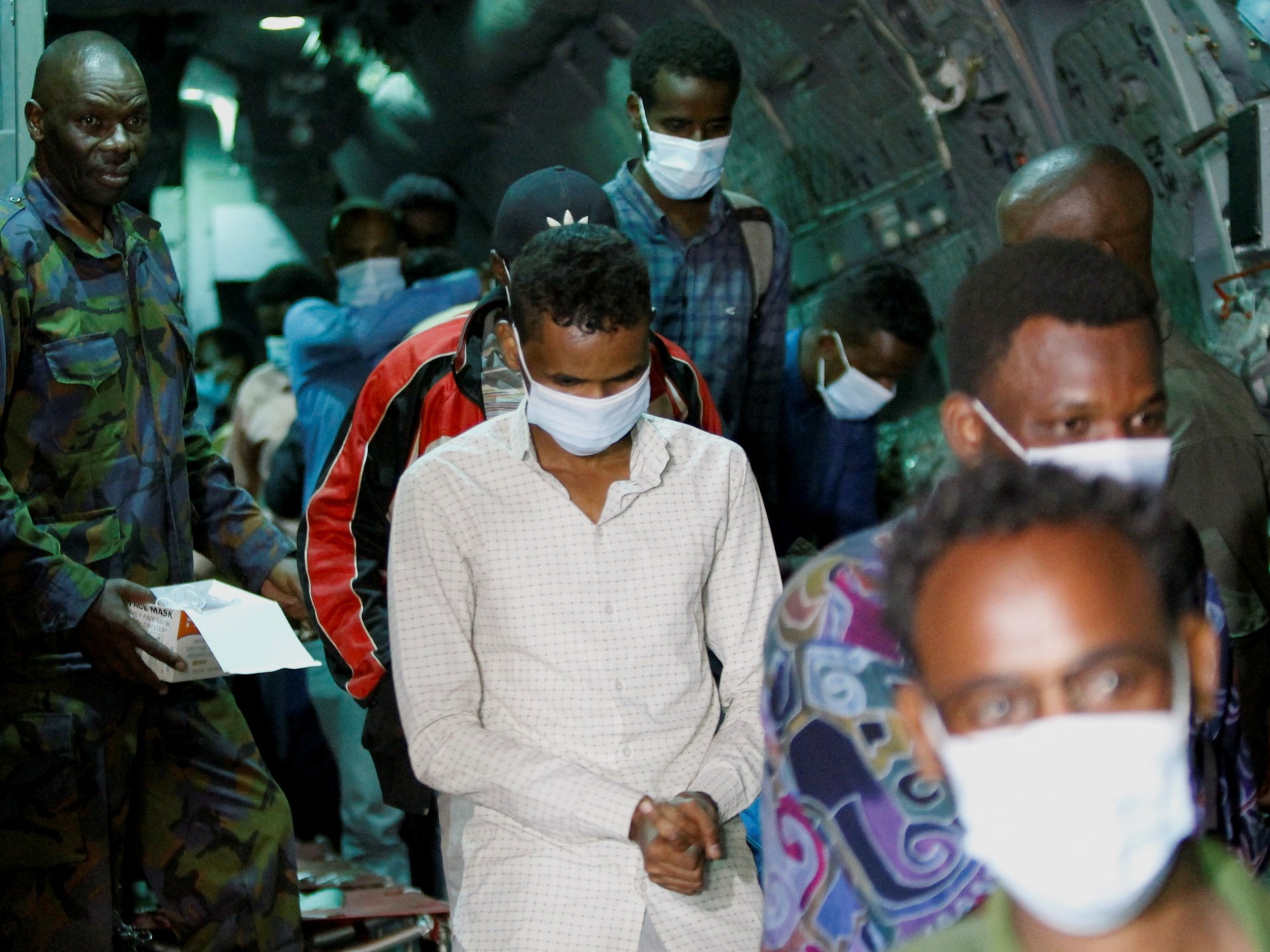

An Related Press reporter on the scene in Port-au-Prince counted 13 our bodies burning in a road. Greater than a dozen suspected gang members in Haiti had been lynched and their our bodies set on fireplace by residents within the capital Port-au-Prince, police and witnesses stated, because the United Nations

Politics

“Warmongering Is not a Power!” Adam Kinzinger’s Try and Dunk on Primarily based Utah Senator Mike Lee Over Ukraine Goes Horribly Fallacious- Will get Brutal Lesson on Power and Manhood | The Gateway Pundit

Nugatory RINO Adam Kinzinger spends his days on Twitter and CNN bashing precise Republicans and pushing reckless insurance policies in Ukraine. In case you disagree with Kinzinger, he calls you a traitor to the Republic and melts down over even probably the most innocuous tweets. His obsession with Ukraine acquired

Business

China’s Deepening Selloff Reveals Traders Are Dropping Confidence

(Bloomberg) — A selloff in Chinese language equities is deepening as merchants weigh a barrage of financial and geopolitical dangers, with world funds accelerating their exodus. Most Learn from Bloomberg The MSCI China Index misplaced as a lot as 2% Tuesday, heading for a sixth day of declines, which would

Entertainment

‘Dangerous Boys 4’, ‘Dumb Cash’, ‘Kraven The Hunter’ Information – Deadline

UPDATED: Sony Photos kicked off the primary night time of CinemaCon on Monday with a taped message from Will Smith and Martin Lawrence from the set of Dangerous Boys 4. Smith beamed: “What’s up CinemaCon? We’re glad we’re not there, trigger we’re right here they usually’re paying us to be

When Malaika Arora REACTED to her notorious duck stroll saying ‘If I’ve a good b**t the place I can serve a seven-course meal…’ [WATCH VIDEO]

Malaika Arora is without doubt one of the hottest divas in tinsel city. She is attractive and she or he is fabulous. No one might be as rocking as her. Even at 49, she is without doubt one of the fittest divas who could make any teen run for her

Princess Kate Proves She’s An Instagram Mother After All

Princess Kate isn’t like the opposite mothers. Not as a result of she’s the longer term Queen Consort or as a result of she has entry to billions of kilos value of jewels—although these do considerably set her aside from the pack, some may argue. She’s additionally a Colonel now, although

Lifestyle

-

April Showers Convey Could Flowers

Disclosure: Thanks to Nordstrom Rack and Collective Voice for sponsoring right this moment’s put up. All merchandise had been chosen, worn, and liked by yours really. The

-

10 House Should-Haves – Idyllic Pursuit

We could earn cash or merchandise from the businesses talked about on this put up. This implies when you click on on the hyperlink and buy the

-

16 Finest Brunch Spots in Austin Proper Now (Up to date for 2023)

For the primary couple of years that I lived in Austin, I lamented the shortage of excellent brunch spots on the town. In fact, this was years